Your Credit Score: What the Number Really Means (and What It Doesn’t)

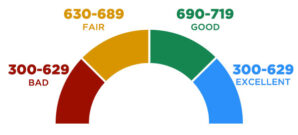

Everyone knows that their credit score is important – but most Americans don’t understand how the scores are assessed or affected by their actions. Ideally, you want a credit score in the 700-800 range, but what does that really mean – and how do you get there?

Everyone knows that their credit score is important – but most Americans don’t understand how the scores are assessed or affected by their actions. Ideally, you want a credit score in the 700-800 range, but what does that really mean – and how do you get there?

Your credit score is calculated by one of the credit reporting agencies – EquiFax, Experian, and TransUnion. These agencies assign your credit score based on current and historical factors, and the score is an assessment of how likely it is that you’ll repay any debts that you accrue. The majority of the score is related to your past payment history and your current level of debt.

Lenders use your credit score to determine how risky it would be to lend you money. With higher credit scores, your loan terms and interest rates will be much better. If you have a lower score, you’ll be assigned a higher interest rate, since the risk is greater for the lender. If your score is low enough, you may not even be approved for the loan or credit card. (more…)

If you’re on our site, you’re either considering bankruptcy or in the process of filing. Don’t be intimidated – we help tons of Dallas-Fort Worth area families just like you with bankruptcy cases every year. It’s an unfortunate truth of life – sometimes bad things happen to good people.

If you’re on our site, you’re either considering bankruptcy or in the process of filing. Don’t be intimidated – we help tons of Dallas-Fort Worth area families just like you with bankruptcy cases every year. It’s an unfortunate truth of life – sometimes bad things happen to good people.

We have helped many hundreds of Dallas-area residents with their bankruptcy cases over the years, and the most common question we hear first is “Should I file bankruptcy?”

We have helped many hundreds of Dallas-area residents with their bankruptcy cases over the years, and the most common question we hear first is “Should I file bankruptcy?” The Great Recession hit America hard from December of 2007 to the middle of 2009, millions of US residents lost their livelihoods and homes. It was the worst economic downturn since the 1930s and the Great Depression, and it took almost a decade for the labor market to fully recover.

The Great Recession hit America hard from December of 2007 to the middle of 2009, millions of US residents lost their livelihoods and homes. It was the worst economic downturn since the 1930s and the Great Depression, and it took almost a decade for the labor market to fully recover. While most of our potential clients ask about what’s involved in a bankruptcy case, and what they need to do when they are filing, many forget to ask what NOT to do… And the things you shouldn’t do before filing are just as important as what comes afterward.

While most of our potential clients ask about what’s involved in a bankruptcy case, and what they need to do when they are filing, many forget to ask what NOT to do… And the things you shouldn’t do before filing are just as important as what comes afterward.

It is Halloween this weekend, so we had to share something scary here on the blog… and this time, we are sharing 4 Scary Ways to Damage Your Debt. Let’s face it – nothing is scarier than overwhelming debt that spirals out of control.

It is Halloween this weekend, so we had to share something scary here on the blog… and this time, we are sharing 4 Scary Ways to Damage Your Debt. Let’s face it – nothing is scarier than overwhelming debt that spirals out of control. The proliferation of credit cards and the “gotta have it now” American lifestyle have lead to a problem: for many Americans, living with debt is par for the course. The changes in America’s financial landscape due to COVID and resulting lockdowns have only made things worse. In many cases, debt spirals out of control until filing for bankruptcy appears to be the only way out.

The proliferation of credit cards and the “gotta have it now” American lifestyle have lead to a problem: for many Americans, living with debt is par for the course. The changes in America’s financial landscape due to COVID and resulting lockdowns have only made things worse. In many cases, debt spirals out of control until filing for bankruptcy appears to be the only way out.