Which rights do you have during a foreclosure?

With foreclosures in the Dallas area on the rise, we are hearing more and more questions about the rights that homeowners have during the foreclosure process. Foreclosure is obviously a challenging and confusing time, and understanding your rights is crucial for navigating the process effectively. Since we know more people are searching for these answers, I wanted to outline the key rights you have as a homeowner in Texas during foreclosure.

With foreclosures in the Dallas area on the rise, we are hearing more and more questions about the rights that homeowners have during the foreclosure process. Foreclosure is obviously a challenging and confusing time, and understanding your rights is crucial for navigating the process effectively. Since we know more people are searching for these answers, I wanted to outline the key rights you have as a homeowner in Texas during foreclosure.

Right to Notice

Notice Before Acceleration: In Texas, before your lender can accelerate your loan (demand the full balance), they must provide you with a notice that gives you at least 20 days to “cure the default” (the official term for paying off the overdue amount and late fees). (more…)

Only 51% of Americans in a recent survey were confident that they could pay off their credit card bills this month – a big increase from the same time period last year. Every month, LendingTree conducts its Credit Card Confidence Index, and the

Only 51% of Americans in a recent survey were confident that they could pay off their credit card bills this month – a big increase from the same time period last year. Every month, LendingTree conducts its Credit Card Confidence Index, and the  The 2023 holiday shopping season is finally upon us. Notoriously, holiday shopping is one of the largest contributors to increased credit card debt – people get in the holiday spirit and spend much more than they should.

The 2023 holiday shopping season is finally upon us. Notoriously, holiday shopping is one of the largest contributors to increased credit card debt – people get in the holiday spirit and spend much more than they should. Whether we are in a recession or not, it is not easy to earn enough to live comfortably in today’s world. You would be surprised to learn how many Dallas-area residents struggle on a monthly basis to simply make ends meed. Adding children or additional vehicle payments to the mix make a difficult situation even tougher. All it takes is one unexpected expense to send finances (and debt) spinning out of control.

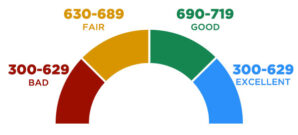

Whether we are in a recession or not, it is not easy to earn enough to live comfortably in today’s world. You would be surprised to learn how many Dallas-area residents struggle on a monthly basis to simply make ends meed. Adding children or additional vehicle payments to the mix make a difficult situation even tougher. All it takes is one unexpected expense to send finances (and debt) spinning out of control. Everyone knows that their credit score is important – but most Americans don’t understand how the scores are assessed or affected by their actions. Ideally, you want a credit score in the 700-800 range, but what does that really mean – and how do you get there?

Everyone knows that their credit score is important – but most Americans don’t understand how the scores are assessed or affected by their actions. Ideally, you want a credit score in the 700-800 range, but what does that really mean – and how do you get there?

The proliferation of credit cards and the “gotta have it now” American lifestyle have lead to a problem: for many Americans, living with debt is par for the course. The changes in America’s financial landscape due to COVID and resulting lockdowns have only made things worse. In many cases, debt spirals out of control until filing for bankruptcy appears to be the only way out.

The proliferation of credit cards and the “gotta have it now” American lifestyle have lead to a problem: for many Americans, living with debt is par for the course. The changes in America’s financial landscape due to COVID and resulting lockdowns have only made things worse. In many cases, debt spirals out of control until filing for bankruptcy appears to be the only way out. Filing for bankruptcy is a huge decision, and usually it has to be made under pretty extreme stress. Your circumstances are unique – so the best way to know if you should file is to call us at 214-760-7777 for a free consultation. The pandemic and ensuing lockdowns have made the situation even more stressful for many DFW area residents. This post will help answer a few high level questions, but it is always better to talk to an expert to get answers about your specific situation.

Filing for bankruptcy is a huge decision, and usually it has to be made under pretty extreme stress. Your circumstances are unique – so the best way to know if you should file is to call us at 214-760-7777 for a free consultation. The pandemic and ensuing lockdowns have made the situation even more stressful for many DFW area residents. This post will help answer a few high level questions, but it is always better to talk to an expert to get answers about your specific situation. The holiday season is upon us again, with Black Friday and Cyber Monday just a few weeks away. The holiday season, and Black Friday in particular, are designed to get Americans to spend as much money as possible. This year, the COVID lockdowns will change the way people shop for the holidays. The doorbuster shopping events won’t happen this year – everyone will be shopping from home.

The holiday season is upon us again, with Black Friday and Cyber Monday just a few weeks away. The holiday season, and Black Friday in particular, are designed to get Americans to spend as much money as possible. This year, the COVID lockdowns will change the way people shop for the holidays. The doorbuster shopping events won’t happen this year – everyone will be shopping from home.