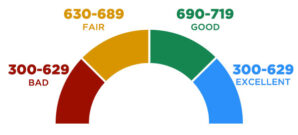

Everyone knows that their credit score is important – but most Americans don’t understand how the scores are assessed or affected by their actions. Ideally, you want a credit score in the 700-800 range, but what does that really mean – and how do you get there?

Everyone knows that their credit score is important – but most Americans don’t understand how the scores are assessed or affected by their actions. Ideally, you want a credit score in the 700-800 range, but what does that really mean – and how do you get there?

Your credit score is calculated by one of the credit reporting agencies – EquiFax, Experian, and TransUnion. These agencies assign your credit score based on current and historical factors, and the score is an assessment of how likely it is that you’ll repay any debts that you accrue. The majority of the score is related to your past payment history and your current level of debt.

Lenders use your credit score to determine how risky it would be to lend you money. With higher credit scores, your loan terms and interest rates will be much better. If you have a lower score, you’ll be assigned a higher interest rate, since the risk is greater for the lender. If your score is low enough, you may not even be approved for the loan or credit card.

How can you check your credit score?

It’s quite easy to check your credit score online. There are multiple websites that allow you to check your credit score for free. Don’t believe the myth that checking your credit using one of the free services will affect your credit. In fact, you should be checking your credit score on a regular basis. Your score will only be affected by a credit check from a lender – this is known as a “hard pull.”

If you are concerned about your credit score or if you are struggling to pay your debts, the experienced Dallas bankruptcy attorneys at Rubin & Associates can help you understand what’s going on and provide several options to help you get your debt (and credit score) under control.

Our Dallas bankruptcy lawyers can help you increase your credit score (don’t believe the myths)

Our experienced bankruptcy lawyers have helped thousands of Dallas-area residents get a fresh start. It doesn’t take much to get caught in a downward spiral of unmanageable debt – the sudden loss of a job, a medical emergency, or an accident might be all it takes to lose financial control. If you are struggling to pay down your credit card debt, medical debt, mortgage, car payments, and more, our team of expert bankruptcy lawyers can explain your options.

There are several myths about how bankruptcy affects credit scores, and the prevalent misinformation online helps to keep these myths alive. Let’s take a look at a few of the most common myths – and expose the truth about each:

MYTH: Bankruptcy hurts your credit score

Ultimately, the only thing that truly hurts your credit score is to do nothing. If you do not pay back debts or even resolve debts with a settlement option, you will destroy your credit score – for a long period of time.

The most common myth about credit scores and bankruptcy is that filing for bankruptcy will destroy your credit. This simply isn’t true. Think of filing for bankruptcy like going to the doctor. If you are extremely ill, you go to the doctor for treatment, which might even involve surgery. While you might experience temporary pain, that pain will subside as you recover. You might even end up healthier than you were before you were ill.

Bankruptcy works the same way. If your debt is spiraling out of control, it will only get worse if you do nothing. When you work with an experienced bankruptcy attorney, you will start the road to recovery. As time passes, your credit score will start to climb – many of our clients have restored their scores to levels they had not seen in years.

If you are struggling with debt, it is important to take action sooner rather than later. Inaction will only make your situation worse – and harder to recover from. Our team will explain your options so that you are able to make the best decision to move forward and take control of the situation.

MYTH: A high credit score doesn’t always reflect reality

If you are a Dallas resident with a high debt-to-income ratio, but you manage to make your monthly payments on time, your credit score might look decent, or even good. Making the minimum monthly payments on time might keep you from the negative hit on your credit report for paying late or being sent to collections – but it will be impossible to ever pay down your debts. If you apply for new credit cards or loans, the lenders will see your high debt-to-income ratio and you’ll be rejected. Your bills will pile up, but your income will remain the same – and at some point, things will reach a breaking point.

While you might have a mid- to high-level score, lenders will see you as a risk, since your income won’t be sufficient to pay back your debts. You won’t be able to get a mortgage or refinance any current loans.

If you are making the minimum monthly payments on your debts, you might think that you are ok – but if you look to the future, you will see that minimum payments will only prolong the inevitable. You need to get your debt under control before something happens to cause a crash. Eventually, the band-aid solution will not work, and you’ll need to take a more strategic approach to control your finances. Our experienced Dallas bankruptcy attorneys can help! Your credit score might take a hit initially, but after you have settled your case and rebuilt your credit, you’ll have a bright future ahead.

Book a free consultation to see how bankruptcy can help

When you schedule a free consultation with our bankruptcy attorneys, we will sit down and listen to your situation. We’ll treat you with compassion and understanding – unlike many of the bankruptcy firms in Dallas who treat you like just another number. We’ll explain every option available so that you can make the best decision for your future – and to help you recover your credit score.

Let our team help you through this stressful time in your life. We will guide you through every step of the bankruptcy process and help you get on the road to financial freedom! Call us any time at 214-760-7777 (or use the link on the page to text us) to set up you free consultation today!