What is a gray bankruptcy?

For the first time in a long time, the overall number of consumer bankruptcy filings increased last year, but gray bankruptcies have been increasing in number every year since 1991. A “gray bankruptcy” is the term for a bankruptcy filed by someone over the age of 65, and it’s a growing problem in America that needs more attention.

For the first time in a long time, the overall number of consumer bankruptcy filings increased last year, but gray bankruptcies have been increasing in number every year since 1991. A “gray bankruptcy” is the term for a bankruptcy filed by someone over the age of 65, and it’s a growing problem in America that needs more attention.

According to the National Consumer Law Center, people 65 and older have approximately four times as much credit card debt as people 25 and younger. This is not that surprising, if you think about it… Between increasing medical bills and the shrinking of social services, many older adults are experiencing increasing financial hardship.

It does not take much to send most Americans into a debt free-fall – unexpected job loss and medical bills are the two most common causes of bankruptcy cases. Once you have retired, you live on a fixed income, so a sudden large medical bill could result in financial disaster. Older Americans have had to turn to credit cards to simply make ends meet. (more…)

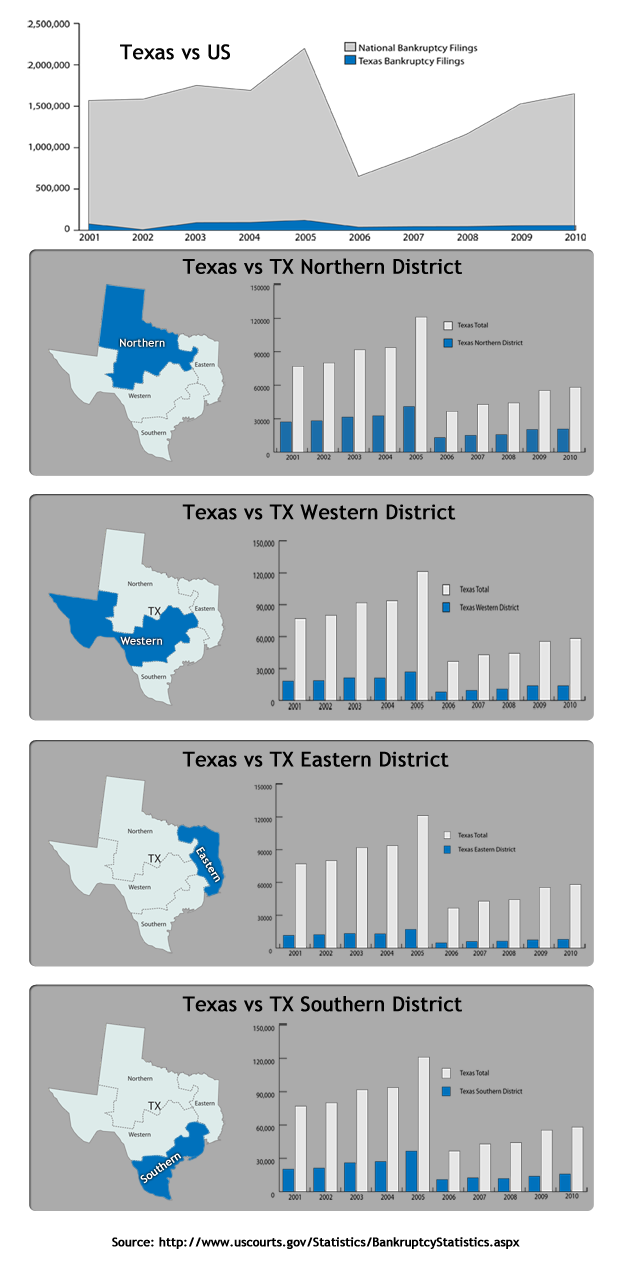

If you’re struggling with overwhelming debt, you’re not alone. Thousands of Dallas area residents have filed for bankruptcy so far this year.

If you’re struggling with overwhelming debt, you’re not alone. Thousands of Dallas area residents have filed for bankruptcy so far this year. Two children, two incomes, a home with a white picket fence; it’s the quintessential American Dream. However, this American Dream has morphed into a survival regimen that many families simply cannot endure.

Two children, two incomes, a home with a white picket fence; it’s the quintessential American Dream. However, this American Dream has morphed into a survival regimen that many families simply cannot endure.