4 Scary Ways to Damage Your Debt

If you are not careful about how you spend your hard-earned money, and even how you conduct transactions online, you can easily start down the path to crushing debt. Today’s post is going to examine the 4 most horrifying ways you can head down a scary financial path.

1. Hackers and scammers

Digital thieves have become incredibly creative – you need to be extremely careful whenever you provide your credit card number to ANY online service. Charities are a common ploy, so make sure you do research on a charity before you make a donation – especially if you are solicited at your front door or over the phone.

The proliferation of credit cards and the “gotta have it now” American lifestyle have lead to a problem: for many Americans, living with debt is par for the course. The changes in America’s financial landscape due to COVID and resulting lockdowns have only made things worse. In many cases, debt spirals out of control until filing for bankruptcy appears to be the only way out.

The proliferation of credit cards and the “gotta have it now” American lifestyle have lead to a problem: for many Americans, living with debt is par for the course. The changes in America’s financial landscape due to COVID and resulting lockdowns have only made things worse. In many cases, debt spirals out of control until filing for bankruptcy appears to be the only way out. One of the most frustrating things about bankruptcy is that it is so misunderstood. You do not really care much about it until you are in a dire situation and need it – and then there is so much myth and misinformation, it becomes an incredibly daunting task to decide how you will proceed.

One of the most frustrating things about bankruptcy is that it is so misunderstood. You do not really care much about it until you are in a dire situation and need it – and then there is so much myth and misinformation, it becomes an incredibly daunting task to decide how you will proceed. Most of our clients come to us, struggling with massive debts that have spun out of control. One unforeseen bump in the road (a sudden job loss, an accident, a medical condition) is all it takes to send most families into a downward debt spiral. We have shared lots of tips in the past for avoiding debt, but it is also important to get advice from a financial advisor or bankruptcy attorney before you decide to file.

Most of our clients come to us, struggling with massive debts that have spun out of control. One unforeseen bump in the road (a sudden job loss, an accident, a medical condition) is all it takes to send most families into a downward debt spiral. We have shared lots of tips in the past for avoiding debt, but it is also important to get advice from a financial advisor or bankruptcy attorney before you decide to file. One of the most common reasons that people file for bankruptcy is to stop foreclosure actions. Rubin & Associates help DFW area residents and property owners with cases like these quite often.

One of the most common reasons that people file for bankruptcy is to stop foreclosure actions. Rubin & Associates help DFW area residents and property owners with cases like these quite often. Filing for bankruptcy is a huge decision, and usually it has to be made under pretty extreme stress. Your circumstances are unique – so the best way to know if you should file is to call us at 214-760-7777 for a free consultation. The pandemic and ensuing lockdowns have made the situation even more stressful for many DFW area residents. This post will help answer a few high level questions, but it is always better to talk to an expert to get answers about your specific situation.

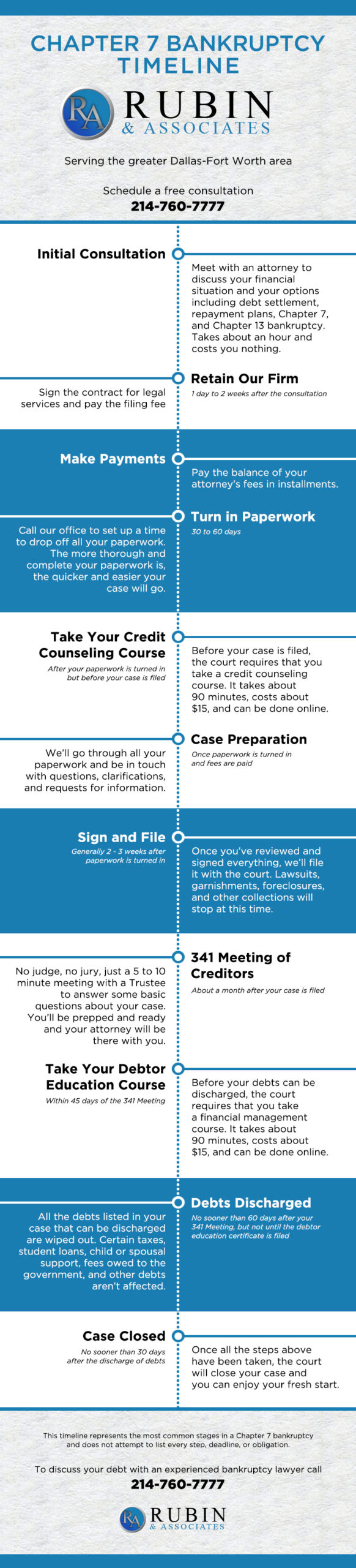

Filing for bankruptcy is a huge decision, and usually it has to be made under pretty extreme stress. Your circumstances are unique – so the best way to know if you should file is to call us at 214-760-7777 for a free consultation. The pandemic and ensuing lockdowns have made the situation even more stressful for many DFW area residents. This post will help answer a few high level questions, but it is always better to talk to an expert to get answers about your specific situation. It’s tax season again, and with the COVID tax delay, taxes are almost due. Every spring, we hear lots of questions from potential clients about the tax implications of filing for bankruptcy. It’s a fairly simple answer – it depends on whether the debt was discharged in bankruptcy or just forgiven by the creditor.

It’s tax season again, and with the COVID tax delay, taxes are almost due. Every spring, we hear lots of questions from potential clients about the tax implications of filing for bankruptcy. It’s a fairly simple answer – it depends on whether the debt was discharged in bankruptcy or just forgiven by the creditor. It’s a question we hear all the time – after a client files their bankruptcy case, they ask us “Should I keep my car?”

It’s a question we hear all the time – after a client files their bankruptcy case, they ask us “Should I keep my car?”