Do I qualify for bankruptcy?

If you are asking yourself, “Do I qualify for bankruptcy?” you are not alone. Many individuals and families in the Dallas, Texas area find themselves overwhelmed by debt and are unsure whether bankruptcy is a viable option. As a bankruptcy attorney, I can assure you that everyone qualifies for bankruptcy relief. The real question is not whether you qualify, but rather which type of bankruptcy — Chapter 7 or Chapter 13 — is the best fit for your financial situation. In this post, I am going to explain the differences and help you understand how the bankruptcy process works. (more…)

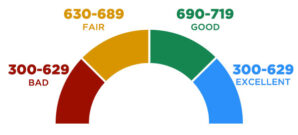

Everyone knows that their credit score is important – but most Americans don’t understand how the scores are assessed or affected by their actions. Ideally, you want a credit score in the 700-800 range, but what does that really mean – and how do you get there?

Everyone knows that their credit score is important – but most Americans don’t understand how the scores are assessed or affected by their actions. Ideally, you want a credit score in the 700-800 range, but what does that really mean – and how do you get there? One of the most frustrating things about bankruptcy is that it is so misunderstood. You do not really care much about it until you are in a dire situation and need it – and then there is so much myth and misinformation, it becomes an incredibly daunting task to decide how you will proceed.

One of the most frustrating things about bankruptcy is that it is so misunderstood. You do not really care much about it until you are in a dire situation and need it – and then there is so much myth and misinformation, it becomes an incredibly daunting task to decide how you will proceed. Most Americans don’t know much about bankruptcy – they’re limited to the knowledge they get from news stories and online gossip columns. Bankruptcy is much more common that most people realize, with over a million people filing for bankruptcy every year.

Most Americans don’t know much about bankruptcy – they’re limited to the knowledge they get from news stories and online gossip columns. Bankruptcy is much more common that most people realize, with over a million people filing for bankruptcy every year. So – all those awful things you’ve always heard about bankruptcy… Did you know that almost all of it is completely untrue? Some of it is rumor, some of it is urban myth, and a lot of the stories are perpetuate by creditors who want you to be scared of bankruptcy.

So – all those awful things you’ve always heard about bankruptcy… Did you know that almost all of it is completely untrue? Some of it is rumor, some of it is urban myth, and a lot of the stories are perpetuate by creditors who want you to be scared of bankruptcy.