Recent Testimonials for Rubin & Associates

Here are a few of the notes and emails we’ve received from our clients:

God Bless You –

Thank all of you for being there to see me through it, from day one until the last day.

Thank you, thank you!

– Barbara

Mark,

I wanted to thank you for taking time to meet with me in person on Tuesday 4/5. I now have a better understanding of the issues with my case. It was important to me to be able to do this, and I can’t thank you enough. Even though I’m aware that the Chapter 13 was the right decision for me, I still have some anxiety about the unknown. You answered all my questions and broadened my understanding of how these things work. It can be very complicated for a lay-person, and I appreciate your plain English.

I’m glad I have you representing me!

Thanks again,

Joey

Thank you so much… PRAISE GOD and Mark Rubin and Associates!!! A HUGE SPECIAL THANK YOU TO KELLI JOHNSON – now it bought me time… I’ve got connection to guy/friend who does home equity loans for those that are challenged. Says he should be able to get it done for me for 50-60k. I’d pay off bankruptcy stuff with it – what do I need to start doing or do is my next question? THANKS AGAIN MY ANGEL KELLI

Craig

Filing for bankruptcy is a huge decision, and usually it has to be made under pretty extreme stress. Your circumstances are unique – so the best way to know if you should file is to call us at 214-760-7777 for a free consultation. The pandemic and ensuing lockdowns have made the situation even more stressful for many DFW area residents. This post will help answer a few high level questions, but it is always better to talk to an expert to get answers about your specific situation.

Filing for bankruptcy is a huge decision, and usually it has to be made under pretty extreme stress. Your circumstances are unique – so the best way to know if you should file is to call us at 214-760-7777 for a free consultation. The pandemic and ensuing lockdowns have made the situation even more stressful for many DFW area residents. This post will help answer a few high level questions, but it is always better to talk to an expert to get answers about your specific situation. Over the last month, over

Over the last month, over

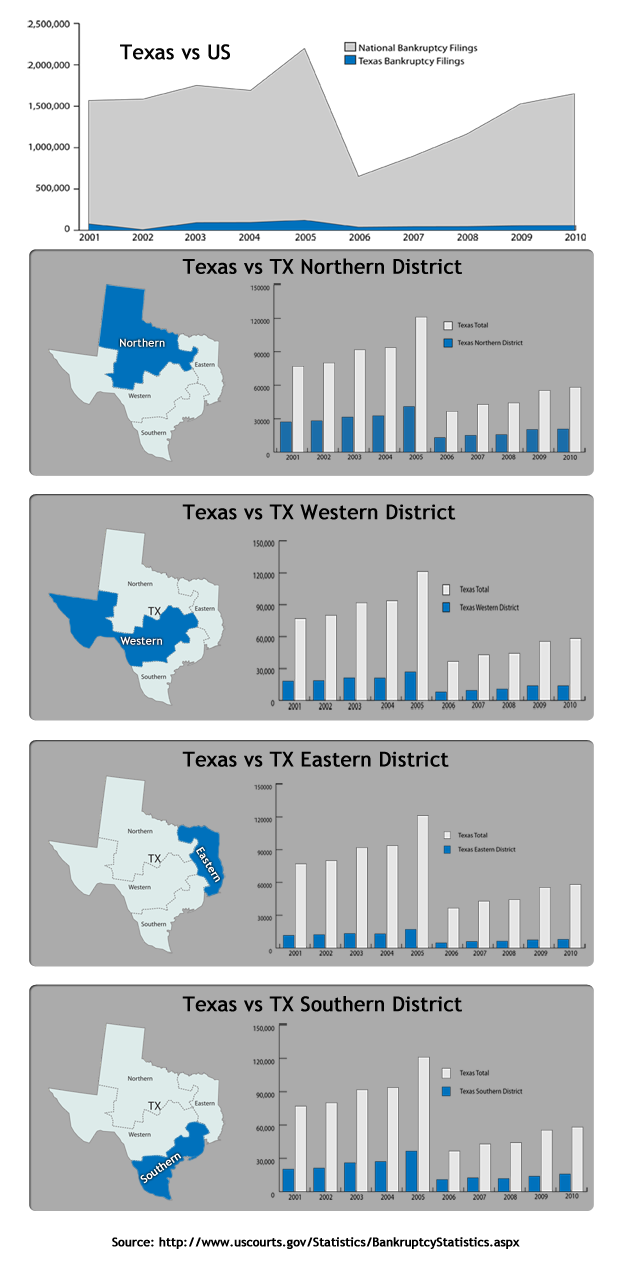

If you’re struggling with overwhelming debt, you’re not alone. Thousands of Dallas area residents have filed for bankruptcy so far this year.

If you’re struggling with overwhelming debt, you’re not alone. Thousands of Dallas area residents have filed for bankruptcy so far this year. It’s tax day, and that means many Americans are finding out that they owe even more money, thanks to the IRS. We always get questions at this time of year about how filing for bankruptcy will affect a family finances. In our last blog post, we discussed what can happen with any potential

It’s tax day, and that means many Americans are finding out that they owe even more money, thanks to the IRS. We always get questions at this time of year about how filing for bankruptcy will affect a family finances. In our last blog post, we discussed what can happen with any potential  Most of the time, if you’re in

Most of the time, if you’re in  Filing for Chapter 7 bankruptcy is arguably the best plan for eliminating debt. It can wash away certain types of debt for good, cleanse you of your stress and financial worries, and free up income for your family. Best of all, it can give you a fresh start to rebuild your credit.

Filing for Chapter 7 bankruptcy is arguably the best plan for eliminating debt. It can wash away certain types of debt for good, cleanse you of your stress and financial worries, and free up income for your family. Best of all, it can give you a fresh start to rebuild your credit.